On April 1, 2024, Centers for Medicare & Medicaid Services (CMS) updated the MMSEA Section 111 Non-Group Health Plan (NGHP) User Guide version 7.5. It has been posted to the NGHP User Guide page on CMS.gov. The NGHP User Guide version 7.5 replaces Version 7.4 which was released on January, 30, 2024.

To download the updated MMSEA Section 111 NGHP User Guide 7.5 click here.

MMSEA III- April 1, 2024 – NGHP User Guide Downloads 7.5

Updates: There are no changes for this version

Updates: There are no changes for this version.

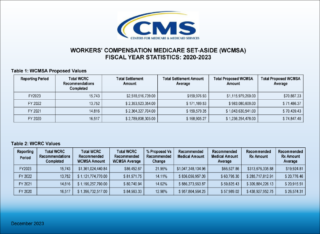

Updates: The submission of information related to Workers’ Compensation Medicare Set-Aside Arrangements (WCMSAs) will be required for all records submitted with a TPOC date after April 4, 2025 (Section 6.5.1.1). As of January 1, 2024, the threshold for physical trauma-based liability insurance settlements will remain at $750. CMS will maintain the $750 threshold for no-fault insurance and workers’ compensation settlements, where the no-fault insurer or workers’ compensation entity does not otherwise have ongoing responsibility for medicals (Section 6.4).

Updates: The submission of information related to Workers’ Compensation Medicare Set-Aside Arrangements (WCMSAs) will be required for all records submitted with a TPOC date after April 4, 2025 (Sections 6.1, 6.4.4, and 6.5). As of January 1, 2024, the threshold for physical trauma-based liability insurance settlements will remain at $750. CMS will maintain the $750 threshold for no-fault insurance and workers’ compensation settlements, where the no-fault insurer or workers’ compensation entity does not otherwise have ongoing responsibility for medicals (Section 6.4).

Updates: Beginning April 4, 2025, CMS will collect information about WCMSAs through Section 111 reporting. To support this effort, related fields have been added to the Claim Input File Detail Record; note that as the current file layout is unchanged, all the not-yet-implemented codes are marked with an asterisk (*) in the field number to distinguish them from the those in the current file layout. Once they are in effect, all the asterisks will be removed and the fields that follow them will be renumbered. Error codes related to these fields have also been added to the Claim Response File Error Code Resolution Table (Appendix A and Appendix G).

Updates: The end-of-line character has been clarified for files using HEW software (270/271 File Translation).

For Additional Information

Medivest will continue to monitor changes occurring at CMS and will keep its readers up to date when such changes are announced. For questions, feel free to reach out to the Medivest representative in your area by clicking here or call us direct at 877.725.2467.